How will retailers survive in a post-Amazon world? This is the question Walmart, John Lewis, etc. have been asking. Yet the best answer (so far) has not come from the large traditional retail players. It has come from startups.

Digitally Native Vertical Brands

Startups have built Digitally Native Vertical Brands (DNVB). They have targeted specific verticals, cut out middlemen and integrated vertically. They have built intimate brands that leverage digital channels and champion customer experience. Some examples include:

- Mattresses - Tuft & Needle, Casper, Leesa, Eve

- Shaving - Harry’s, Bevel, Dollar Shave Club (acquired by Unilever for $1bn)

- Suitcase - Away

- Glasses - Warby Parker

- Makeup - Glossier

- Oral Care - Quip

- Clothes - Everlane, Bonobos (acquired by Walmart for $310m)

- Contact Lenses - Waldo, Hubble

- Kitchenware - Year & Day

- Furniture - Burrow

- Flowers/Plants - Bloom & Wild, Patch

- FemCare - Callaly, Lola

- Dog Food - Butternut Box, Tails

- Pharmacy - PillPack (acquired by Amazon for $1bn)

I’ve borrowed the term from Andy Dunn, founder of Bonobos, one of few retail brands to thrive in post-Amazon USA. He should know something about brands, right?

So, what are the features of these DNVB brands?

Targeted Verticals

Previously, retail stores appealed to convenience. Consider Walmart, Target (US) or John Lewis (UK). They cover many different verticals including kitchenware, furniture, toys, etc. Differently, the new DNVB’s focus their efforts on one single vertical.

Single focus can increase the chances of success for a brand.

From a marketing perspective, the brand is more targeted. For customers, it’s easier to understand and remember what the brand does. Take Dollar Shave Club or Bloom & Wild, from their names alone it is clear what vertical they focus on.

From an operational perspective, these focused startups can go deep on gaining expertise. One vertical means resource isn’t spread too thin. The result is better quality products.

Single vertical focus is key when you additionally consider…

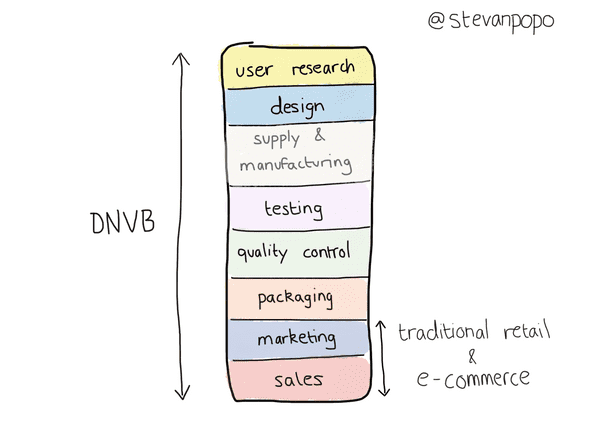

Vertical Integration

DNVB’s deliver value along the whole supply chain. They do user research, design, testing, quality control, supply, manufacturing and packaging before they market and sell the final product. The brand name appears on the website, marketing, packaging and the product itself. To execute this requires domain-expertise, operational excellence and serious investment.

DNVB’s are not e-commerce sites. They are not just well-designed websites that are easier to transact on. Having said that…

Digital-First Distribution

DNVB’s are born in the internet age. The brand website is a core part of its customer experience, not a supporting element. Websites are well designed, easy to use and optimised for conversion.

The founders of DNVB’s are often engineers and growth experts. They understand Google search terms and Facebook brand campaigns. They know what it means to build traffic, optimise a conversion funnel and interpret feedback. Then they iterate on the process again.

A key benefit of a digitally native brand is its ability to track a customer along the whole lifecycle. In a physical retail store, the customer is often invisible. You don’t know where they have come from, or why they stopped by. Conversely, a DNVB knows what channel you came from, which products you looked at and for how long. They can change the online experience based on these factors and re-target you at a later date should you need more convincing.

Focus On Customer Experience

These startups take a holistic view of the customer experience. They ensure the customers touch-points with the brand is of as high a quality as the product itself. This includes, but is not limited to:

- Delivery - To your door and often at no extra cost.

- Subscription - When suitable, these businesses often offer a flexible subscription service.

- Customer support - In traditional retail, you’re referred between retailer, wholesaler and supplier. None with clear ownership of your problem. In a vertically integrated brand, the relationship is direct. The ownership of your problem is clear. Therefore, DFVB’s are aligned to deliver better customer support.

- Guarantees - When you can buy a mattress online, having only seen images on the internet, the guarantee gives assurance. It excuses you of worry and signal’s brand confidence.

All these factors contribute toward Net Promoter Score (NPS). In short, NPS reflects a customer’s likelihood to recommend the service/product to others. Whilst anecdotal, I have listened to several DNVB founders on podcasts1. They usually seem very focused on NPS scores

No Middlemen

A feature of many DNVB’s is to cut out any middlemen. Take the vertical’s of clothing, mattresses or furniture. In traditional retail, the manufacturer does not own the relationship with the customer. The product may go through a distributor, wholesaler and retailer before reaching the customer. Each adding their margin (your cost) along the way.

In contrast, by going direct-to-consumer DNVB’s keep a higher margin on the final product2. As a result, they can serve the product at a more affordable price and invest back into improving the customer experience.

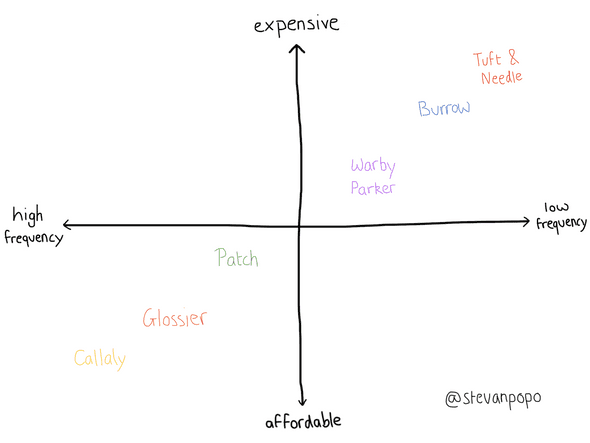

Frequency Of Purchase vs. Large Ticket Items

DNVB’s tend to focus on either end of this spectrum. The end of the spectrum, in turn, tends to influence their USP.

For large ticket items, DVNB’s USP’s tend to be up the stack. Consider a mattress which can cost £700. It is more effective to be 10% cheaper (save £70!) than have a slicker website.

Conversely, for high-frequency purchases, the focus shifts down the stack. Quality remains important. But there is extra focus on continual brand interactions, flexibility of service and customer support3.

In conclusion, as Amazon continues to eat worldwide retail, the DNVB offers the stiffest resistance4. By going deep on the vertical value chain and focusing on customer experience, success cases have emerged (e.g. Dollar Shave Club and PillPack $1bn acquisitions).

Looking for a business idea in 2018? Ask yourself: What product sold in physical retail stores is characterised by low quality and poor experience? Lamps? Scented candles? That’s two startup ideas I’ve had from glancing around my living room. The retail war post-Amazon lives on.

[Update - 26th August 2019] - There is another retailer who is succeeding alongside Amazon - Costco. I recently came to learn more about Costco as a business and it is super impressive. The Reslience of Costco shares some great analysis on why the retailer constinues grow and profit.

[Update - 15th September 2019] - I came across this website that highlights the latest and best DNVB on Shopify, commercecream.com.

-

This IndieHackers podcast with Tuft & Needle founder JT Marino is great.

↩ -

This is only true if the marketing costs of owning the customer relationship are well managed.

↩ -

Of course, a great brand will innovate across the full stack regardless of price point. However, in the case of expensive items, the price is often a greater concern. In the case of physical products, the price is decided up the stack. Think better material sourcing, design and manufacturing. DNVB innovations often happen in supply chain, factories or business models.

↩ -

For a deep-dive on how Amazon has managed to take over retail, I recommend the book, The Everything Store. For a more critical view on Amazon's growth, see The Four (my notes on this book are here).

↩